- Plentiful and cheap fossil fuel reduces the incentive for greener innovations. Resulting in a surge in global warming and catastrophic climate changes

- Countries with access to large reserves of shale gas and weak environmental lobby groups will offer industries that consume massive amounts of energy (think mining, iron, motor manufacturing etc) low cost advantages allowing them to compete “unfairly” on a global level

- A world where the Middle-East and Russia are no longer the leaders in the supply of strategic energy resources

- Europe lags behind in the development and extraction of shale gas. Industries there fall behind in competitiveness as they absorb higher energy costs into their value chain.

The potential of shale gas to disrupt industries, provide a new wave of productivity and change the global competitive dynamics is huge. The Economist has written one of the best articles on this subject. You can read it below or on their website – see The Economist

America’s oil bonanza

A good thing—but it would be better if energy was priced

correctly in the United States

Nov 17th 2012 | from the print edition

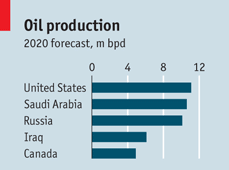

THE shale-gas revolution in America has been as sudden and startling as a supertanker performing a handbrake turn. A country that once fretted about its dependence on Middle Eastern fossil fuels is now on the verge of self-sufficiency in natural gas. And the news keeps getting better. This week the International Energy Agency (IEA) predicted that the United States would become the world’s largest oil producer by 2020, outstripping Saudi Arabia and Russia (see article).

Why has this happened? Price signals work. Oil has been costly for more than a decade. This has spurred prospectors to look harder for unconventional fuels: oil and gas that lie deep under the sea, buried in shale beds or stuck in Canada’s vast oil sands (see article). They have developed whizzy technology to extract these hydrocarbons, with such success that North America now has a gas glut. Prices have plummeted, prompting shale-gas frackers to drill for pricier shale oil instead. According to the IEA, America could become self-sufficient in energy by 2035. Bolder analysts say sooner. Canada has immense potential, too. Besides the oil sands, a recent report suggests that the province of Alberta alone may have shale gas and oil reserves to rival America’s.

The North American hydrocarbon bonanza offers big benefits, but also some pitfalls. The economic pluses are obvious: cheap gas yields cheap electricity, which boosts American industry, especially power-hungry sectors such as aluminium, steel and glass. Cheap gas also buoys petrochemicals firms, which use it to make useful stuff such as plastic. Also, America consumes some 19m barrels of oil a day. Imported oil costs $109 a barrel. Not having to pay Saudi Arabia for this is a boon.

The environmental scorecard is more mixed. Burning fossil fuels adds to greenhouse-gas emissions, which cook the planet. But the dash for gas has reduced American emissions, since gas is cleaner than coal. By contrast, in Europe, which does have a carbon-trading system but never developed shale gas, emissions have risen over the past three years. Europeans are shuttering nuclear-power plants and backsliding to filthy coal.

How to use a windfall wisely

It will be years before renewable energy is cheap and reliable enough to replace fossil fuels entirely. For now, hydrocarbons and the warming they bring with them are necessary evils. Rather than trying to distort their supply, the American government’s job should be to let the oil and gas flow, where it is safe; but at the same time force those who use it to pay the full costs of that fuel—including those to the environment and the planet—and seek to spread the development of alternatives.

America has got the first part of that right, especially when it comes to encouraging innovation. Its landowners own the minerals below their turf, giving them a huge incentive to allow exploration (unlike Europe’s). There are a few barmy rules, such as a ban on crude-oil exports, but it can still sell the refined version. Barack Obama should approve the proposed Keystone XL pipeline, which would carry Canadian oil to the Gulf of Mexico. Greens fear leakages, but overland pipes are far less risky than, say, shifting oil in trucks, and the pipe’s owners would have to pay for any clean-up.

Where American energy policy is far less sensible is when it comes to the price reflecting the true cost. Tiny petrol taxes take no account of the damaging effects of pollution. This newspaper has long argued for a carbon tax to make dirty energy more expensive and thus curb demand. If that happened, some of the new oil might not be worth extracting: Canada’s heavy oil, for instance, emits about 6% more carbon dioxide than normal oil, which in turn can be 30% dirtier than gas. The biggest bonanza from all this new energy would be if the users paid the real cost of consuming oil and gas.