“Many business leaders will realise, soon, that they are underinvesting in North America” says Joel Kurtzman a leading figure in the U.S. on the future of business. Joel founded the Booz & Co magazine Strategy+Business and is also a senior fellow at the Milken Institute, an economic and finance think tank. This is an interesting prediction especially as the prevailing wisdom suggests that companies should be focusing on the emerging BRIC nations. So should you take note of Joel’s prediction or is it the hype of an American consultant longing nostalgically for the return of America’s golden era? If Joel is right however, there will be important strategic implications for businesses, consumer confidence and the future of global economic growth.

At TomorrowToday we specialise in understanding disruptive forces and for over a decade we’ve been making sense of a changing world. Our research on disruptive forces indicates that economic and political power is shifting distinctly East as well as South away from the U.S. This trend, we believe is likely to continue for the next two to three decades until a new equilibrium is reached in the global economy. So on the face of it our research does not support Joel’s prediction. However, this is where it get’s exciting because disruptive forces have an uncanny knack of creeping up and catching business leaders suddenly off guard. To remain vigilant leaders need to seek out the voice of dissent, find the voice that goes against reason because these can often be the weak signal that things are about to change or be disrupted. For example, back in 2005, Raghuram Rajan, a chief economist at the International Monetary Fund, attended the top central bankers’ get together in Jackson Hole, Wyoming, to present a paper on how the financial sector had evolved during Alan Greenspan’s era and gave a presentation that his listeners could never have expected. He argued that increasingly complicated instruments like credit-default swaps and mortgage-backed securities, had made the global financial system a riskier place, not less so as many believed. His presentation at the time represented the voice of dissent, under Greenspan the global financial market had never seemed more stable and Rajan’s audience didn’t take him very seriously. Three years later in 2008, however, his views proved prophetic. Rajan has since been credited with generally predicted the sources of the worst financial collapse since the Great Depression of the 1930s.

So as the global economy navigates to a point of equilibrium, the forces of disruptive change will make the journey somewhat turbulent and if Joel’s prediction represents the voice of dissent, it’s worth considering it in more detail. Using our TIDES of Change model on disruptive forces I’m going to test Joel’s prediction. The TIDES model assesses the impact of five disruptive forces – Technology, Institutional Change, Demographics, Environment & Ethics and Shifting Social Values.

Does Technology support Joel’s prediction?

The first force Joel refers to (he identifies four forces in total) is technology based and refers to recent developments in horizontal fracking that have resulted in the realisation of cheap and plentiful energy in the form of shale gas. We’ve been predicting the impact fracking will have for the past four years and the developments in technology and knowledge in this area are mind-blowing with huge implications for global competitiveness. In 2012, The Economist estimated that by 2020 the U.S. would become the world’s largest producer of oil and gas – surpassing Russia and Saudi Arabia. The U.S. achieved this milestone a lot sooner than expected. In fact by July of 2014 the U.S. has already become the largest producer of oil and gas, beating The Economist’s estimate by a staggering six years. Within the space of only a few years the U.S. has reduced its oil and gas imports from 40% of total consumption to only 14% and this figure is dropping further. Shale gas is plentiful and cheap in the U.S., so cheap in fact that the U.S. may soon pay only a quarter of what Europe and Asia pay for gas. This translates to a gigantic competitive advantage and one the U.S. is exploiting at full speed. European countries are ensnarled in debating the merits and environmental dangers of horizontal fracking and dancing the dance for green activists, while the U.S. is fast leaving everyone behind. The disruption that fracking is delivering is monumental. We do not believe there are any historical precedents.

Other notable technologies that Joel does not mention include 3D printing and the Industrial Internet. GE’s chief economist calculates that the Industrial Internet will result in economic gains of up to $14 trillion. The U.S. will benefit hugely from these two technological trends, more so than other nations due to the advanced nature of its economy. Combined with cheap energy from fracking these technological developments support Joel’s prediction for a more prosperous America.

So yes, recent trends in technology would support Joel’s prediction.

Does Institutional Change support Joel’s prediction?

The second force can be best understood in the context of institutional change. Institutions are the regulatory bodies, organisations and societal structures that provide the blueprint for how things are done. They typically protect what is considered “normal by providing rules or encouraging certain behaviours of compliance. In the traditional or normal manufacturing model, goods are produced in low-wage emerging countries and then sold in the consumer rich developed countries. This is the normal route to market. But recent disruptions are tipping the equation in favour of shifting manufacturing to North America. There are several reasons, cheap energy in the form of shale gas is one, we’ve already discussed this. The other is productivity. Robotics and automation are ramping productivity levels upwards dramatically. The U.S. produces about seven times as much manufacturing output per employee as China does, and, because productivity has leaped forward faster than wage increased, labour in North America is not much more expensive than it is in Asia. Add to this the increasing costs of transportation and proximity to the largest economy in the world and you can see why companies like BMW are making vehicles for the whole world in North America. Once you do the figures, the overall costs and leadership advantages make a compelling argument for operating out of North America.

The other huge institutional shift is the enormous amount of capital available for investment. Almost $6 trillion in deposits and uninvested liquid assets exist in the private sector and Federal Reserve. Households have also benefited from historically low interest rates since the Great Recession placing more disposable money in their pockets. The Great Recession also made many Americans more frugal and they have been putting money away. Saving levels in U.S. are now close to worldwide levels and households have $60 trillion in assets, much of which could be invested. This represents enough capital available to kick-start an entirely new future.

So yes, recent trends in Institutional Change would support Joel’s prediction.

Does demographics (generations) and Shifting Social Values support Joel’s prediction?

The third force Joel talks about is a social force. The American culture is more oriented towards risk taking and creativity. Even though Asian countries are investing heavily in R&D they are not translating into many scientific breakthroughs. The hand-break is a cultural one. China like most cultures around the world, have lower tolerance for nonconformity and risk taking. Joel provides an excellent example of Joichi Ito – a college student drop out with no management experience who heads up MIT’s Media Lab. Joichi is the guild leader of the online multiplayer computer game World of Warcraft. As Joel puts it “That’s not a typical CV for the leader of a major academic R&D facility, but the U.S. has that kind of tolerance for difference.”

This cultural shift is also a generational disruption. Generation Y or Digital Natives of which Joichi is a member believe that if you are good enough, you are old enough, regardless of age, race or gender to lead a business. This is not something that sits easily with older generations some of whom have waited years patiently working their way up the corporate ladder to get to the top. Nevertheless values have shifted and today meritocracy increasingly rules in the workplace.

So yes, recent demographic and shifting social values trends would support Joel’s prediction.

Does the environment and Ethics support Joel’s prediction?

In his book Unleashing the Second American Century, Joel argues that America’s increasing prosperity will be founded on four forces covered above namely: cheap energy, transformed manufacturing, creative culture and enormous amounts of investment capital. Overlaying these four forces with TomorrowToday’s TIDES model the results suggest that Joel may well be onto something that conventional mindsets are overlooking. The competitive forces have realigned in North America’s favour. With knowledge, capital and technology America is going to continue t be a formidable global market and global competitor.

However, Joel neglects one of the most powerful disruptive forces that we track: Environment and Ethics. These two forces have the power to upset the apple cart with devastating effect negating all the benefits of the four forces that Joel uses to support his argument and this highlights a weakness in his prediction.

Firstly, environmental forces: Technology developments in fracking have resulted in a bounty of cheap energy for the U.S. It’s free-market economy with minimal regulatory and governmental interference (the U.S. is one of the few countries where individuals and companies can own mineral rights), mean that the true or real cost of cheap energy – including the negative impact on global warming and pollution – will not be factored into the overall cost. The current pricing strategy for America’s cheap shale gas make no adjustments for future societal costs. Advances in cheap natural gas will also result in less political support for the more expensive green energy technologies. As a result the fight against global warming stands to be lost here. North America has enough shale gas to last at least another 200 years, the urgency to find cleaner and greener alternatives will no longer remain and the country with the highest CO2 emissions will continue to contribute disproportionately to global warming. And no President of the U.S. will oppose this or legislate that cheap energy needs to have a social cost factored into it.

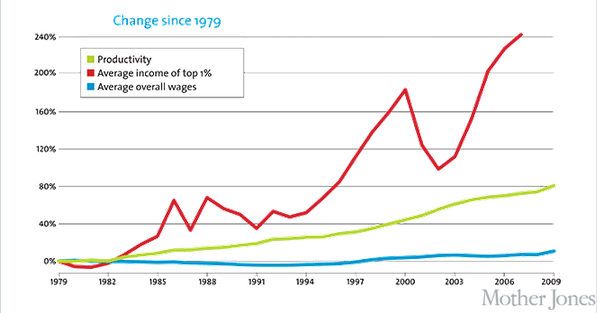

Ethics is another important disruptive force not taken into account by Joel’s prediction. The growing inequality gap in the U.S. is not sustainable neither is it ethical. The top 1% of Americans control 40% of the nation’s wealth, while the bottom 80% only controls 7%. The richest 1% take home almost a quarter of the national income, compared to only 9% in 1976, meaning the share of income of the top 1% has nearly tripled in the last three decades. The top 1% own half the U.S. stocks, bonds and mutual funds, compared to the bottom 50% of the population who own only half a percent of these investments. Let’s put these stats in more identifiable terms – the average worker need to work more than a month to earn what the CEO makes in one hour. If the Occupy Movement does nothing else, it has at least introduced a new set of terms into the American vocabulary to talk about the distribution of wealth in America. These levels of inequality have the potential to become the most powerful disruptive force facing North America and it is a force that is not being adequately addressed. We only need to look back in history to see what happens when the 99% say enough is enough. By 2030 an individual will have the capability to wreck it all by unleashing a biopathogen. America needs to address the growing levels of inequality, not only nationally but globally, otherwise it stands to loose all the potential gains and more. A final fact to consider here, over the past three decades productivity in the U.S. has increased by 80 percent. With Automation and robotics Joel sees even greater future gains. However, income has not risen accordingly. In fact in real terms it has barely risen at all. America is sitting on an inequality time bomb. The graph below captures the problem.

The overall case for economic optimism in North America’s future.

Our TIDES model on the whole supports Joel Kurtzmann. As a voice swimming against the current, his predictions seem to hold water. Leaders therefore need to be paying attention to this new trend. The four forces that Joel identifies could well unleash a staggering wave of growth and innovation in North America. However, two powerful forces: the impact of global warming (resulting from the release of cheap energy to re-energise America’s flailing manufacturing sector) and growing wealth inequalities stand to disrupt this party and unfortunately Joel has not factored these disruptive forces into his predictions and his model is therefore flawed overall. There is a case for optimism but America’s future is still shaky and the future certainly does not look as smooth as Joel would like us to believe it will be. North America stands to gain considerable advantages but these gains could all be wiped away if business, regulators and politicians do not strategically manage the disruptive forces of environment and ethics.

The TIDES of Change model can be used to help you understand the impact of disruptive forces will have on your business. Dean van Leeuwen is a co-founder of TomorrowToday Global and an international speaker on disruption and leadership strategy. Please contact Wendy if you would like to hear more or to book one of TomorrowToday’s speakers for you next team event.